Introduction

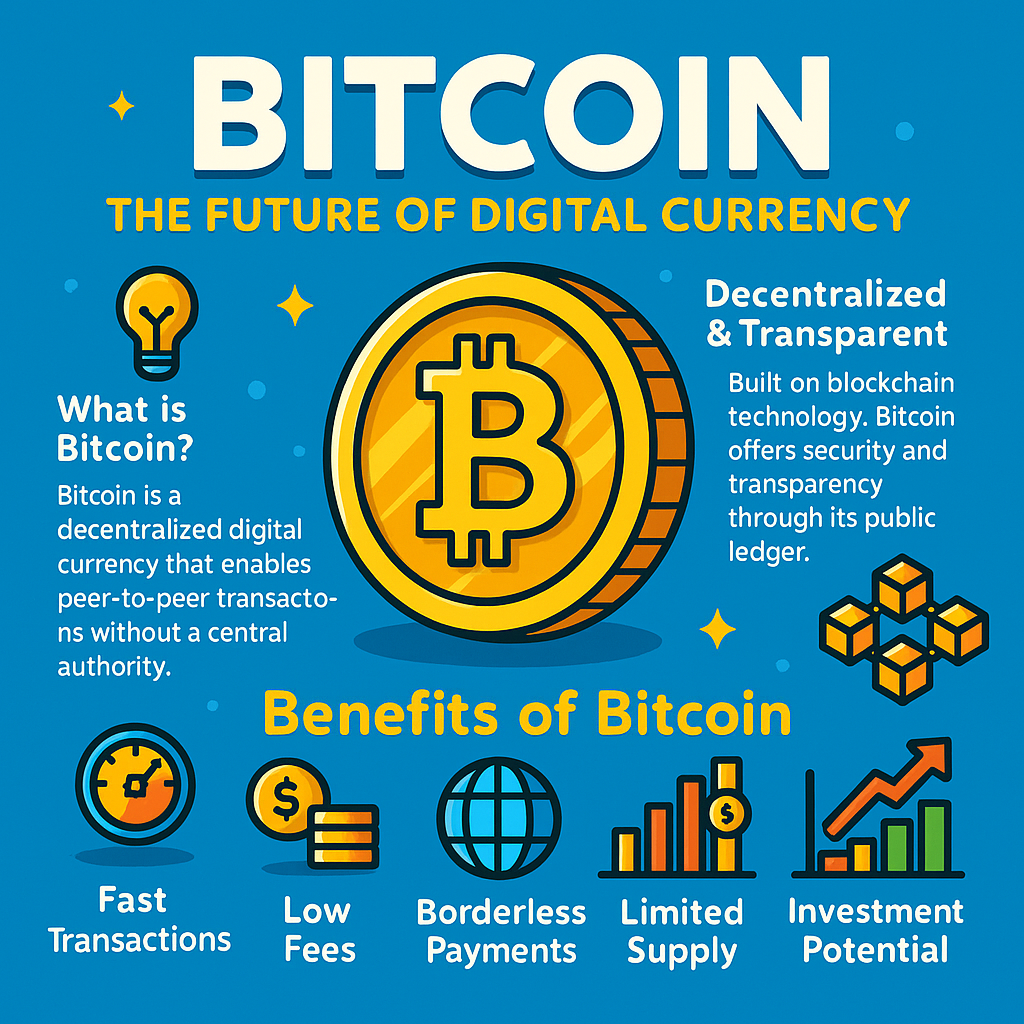

Bitcoin is the first and most recognized cryptocurrency—a digital currency that operates without a central authority. Created in 2009 by the pseudonymous Satoshi Nakamoto, Bitcoin runs on a decentralized, peer-to-peer network powered by blockchain technology, enabling secure value transfer without banks or intermediaries.

What Makes Bitcoin Unique

Bitcoin’s blockchain is a distributed ledger that records every transaction across thousands of computers worldwide. This transparency helps prevent fraud and double-spending while ensuring data is secure and verifiable. New transactions are confirmed through mining, where specialized computers validate blocks and add them to the chain.

Key Benefits of Bitcoin

- Decentralization - No single government or institution controls Bitcoin, giving users true ownership and independence.

- Security - Cryptographic proofs and a global network make transactions extremely difficult to alter or counterfeit.

- Global Accessibility - Anyone with an internet connection can use Bitcoin, regardless of location or banking access.

- Lower Fees - Transfers can be cheaper than traditional banking or international remittances, especially for cross-border payments.

- Transparency - All transactions are publicly verifiable on the blockchain, creating a permanent, auditable record.

Bitcoin as an Investment

Often called “digital gold,” Bitcoin has a hard-capped supply of 21 million coins. Its price history shows high volatility alongside long-term growth, attracting investors who accept higher risk for potential outsized returns. Growing adoption by payment processors, financial institutions, and fintech platforms continues to expand its utility.

Risks and Considerations

- Volatility - Prices can swing dramatically in short periods, impacting portfolio stability.

- Key Management - Losing private keys means permanently losing access to funds; there is no recovery hotline.

- Regulatory Shifts - Policy changes can affect exchanges, custody, and taxation.

- Security Hygiene - Users must practice strong security (hardware wallets, 2FA) to reduce theft or phishing risks.

The Future of Bitcoin

As infrastructure, regulation, and institutional participation mature, Bitcoin is poised to play a larger role in global finance—from value storage and cross-border settlements to serving as collateral in emerging digital markets.

Doorzy Tech

We embrace innovation and help businesses understand transformative technologies like Bitcoin and blockchain. From education to integration strategy, our goal is to keep clients informed and future-ready as digital finance evolves.

Conclusion

Bitcoin is more than a digital currency—it’s a shift toward transparent, borderless, and user-owned finance. Whether you’re a business owner, investor, or curious learner, exploring Bitcoin today can prepare you for the next era of financial technology.